To accurately determine how much profit you make from selling a product on Amazon, you must first know your true landed cost—what it cost you to get one unit of your product into an Amazon fulfilment centre, ready to be sold.

This landed cost is referred to as your Cost of Goods Sold (COGS), and it is central to calculating profit with precision.

COGS in SellerLegend is time-based. You can define as many cost periods as needed to reflect changes in product costs over time. This article explains how to add, edit, and maintain your cost history with precision — and avoid profit reporting gaps.

🧱 What Makes Up a Unit’s Cost?

The total cost to bring a product to market isn’t just its factory price. It’s the sum of multiple granular cost components, or what we call Cost Elements in SellerLegend.

These can include:

-

🏭 Manufacturing Costs

-

🧾 Printing and Packaging

-

🏷️ Labelling

-

🚚 Shipping & Freight

-

🛃 Customs & Duties

-

🔍 Quality Inspection

-

📦 Handling & Prep

-

📋 Any other product-related costs

Each of these Cost Elements contributes to the total Unit Cost of your product.

📏 Understanding Cost Per Unit

Some costs are provided directly per unit, like:

Example: Manufacturer quotes $3.99 per unit.

Other costs are not unitized, like:

Example: Shipping company quotes $2,285 for a shipment of 400 units.

To use these in COGS calculations, you must convert them to a per-unit cost:

$2,285 ÷ 400 units = $5.71 per unit shipping cost

SellerLegend simplifies this process in the Detailed COGS Entry Form, which helps you apportion service-based costs (like shipping or inspection) across the number of units in a shipment.

🧮 Total COGS Value = Sum of Cost Elements

Once all Cost Elements are converted to per-unit costs, the total COGS is calculated simply as:

This COGS value is what you’ll subtract from your revenue to compute true profit (though profit calculation is outside the scope of this article).

⏳ What Is a Cost Period?

COGS isn’t static. It changes over time—due to:

-

🎢 Manufacturer price changes (e.g., raw materials fluctuations)

-

🚢 Shipping cost changes (e.g., seasonal or fuel surcharges)

-

📈 Quantity-based discounts or premiums

-

🧪 More (or fewer) inspections

-

Currency exchange rates

-

New freight or packaging costs

-

Bulk discounts or surcharges

Since the unit cost changes per shipment or consignment, SellerLegend lets you assign different COGS values to different time periods.

This is known as Period-Based COGS Tracking.

A cost period is a date range during which a specific unit cost applies to a product.

Each cost period includes:

-

A Start Date

-

An End Date (optional — leave blank for ongoing)

-

A Unit Cost

-

Optional: provider, notes, currency, etc. (in Detailed View)

By creating new cost periods, you:

-

Maintain accurate historic profit data

-

Avoid retroactively altering earlier calculations

-

See how profit margins evolve over time

SellerLegend matches the cost to each order based on the order date.

🔄 How It Works

You tell SellerLegend:

“From

Start DatetoEnd Date, COGS for Product X was $YY.ZZ”

When a new shipment arrives with a different cost, you define a new COGS period. SellerLegend will:

-

Match each product sale to the correct COGS based on the order date

-

Automatically recalculate your profits whenever COGS data changes

🧠 Tips & Flexibility

-

✅ Future-date COGS entries (e.g., for an upcoming shipment)

-

✅ Retroactively change dates or unit prices

-

✅ SellerLegend automatically reassigns orders to the correct cost period

-

✅ Profits are recalculated instantly when you make any COGS changes

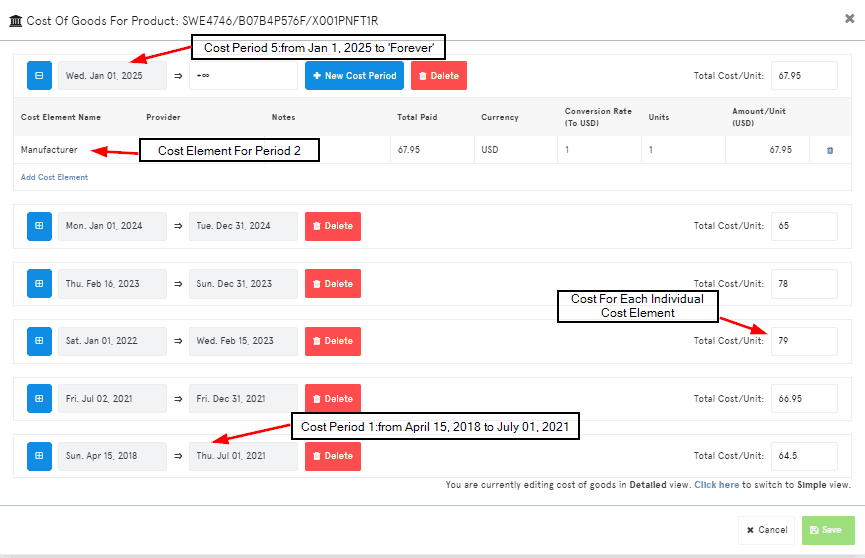

🖥️ COGS Concepts in the SellerLegend UI

To visualize how COGS and Cost Periods work, head to the COGS screen.

There you’ll see:

-

Cost Periods listed in reverse chronological order

-

Each period showing its start and end dates

-

All Cost Elements active during each period

Example:

📅 Cost Period: Jan 01, 2025 – Present

🏭 Manufacturer Cost: $67.95/unit

📅 Older Period: Apr 15, 2018 – Jul 01, 2021

🏭 Manufacturer Cost: $64.50/unit

📥 Bulk Upload Option

If you prefer working with spreadsheets, you can also define your COGS and cost periods using a bulk upload Excel sheet. See the full guide here:

👉 COGS Bulk Upload Instructions

🎯 Why This Matters

Period-based COGS ensures your profit metrics are:

-

🔍 Accurate — matched to the real cost at the time of sale

-

📈 Granular — down to the unit and shipment

-

🔄 Flexible — easily updated as your business evolves

If you ignore period-based COGS, you risk misstating profit, especially in volatile cost environments.

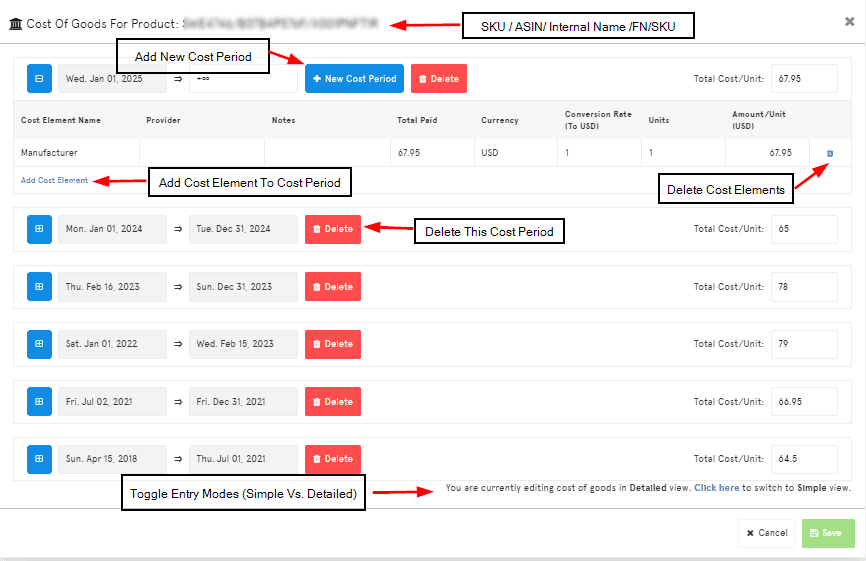

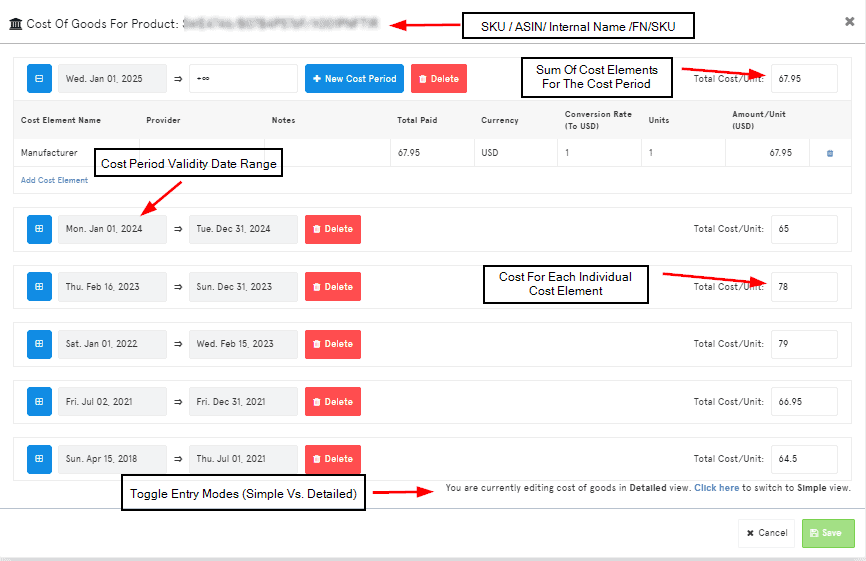

The COGS Concepts Explained Using The COGS UI

- In this section, we will use the COGS UI to help you form a visual representation of Cost Periods Vs Cost Elements

- If you want to perform a bulk COGS upload you do not use the UI, you use an Excel sheet, explained at this link COGS Bulk Upload

Cost Periods Vs Cost Elements

- The following image shows a product with 5 cost periods

- Notice that the UI shows the cost elements in reverse chronological order, with the most recent one first

- The first (oldest) cost period runs from April 15, 2018 to July 01, 2021

- The last (most recent) cost period runs from Jan 01, 2025 and runs forever (that is, until you eventually decide to add a more recent cost period)

- The most recent Cost Period has just one Cost Element (manufacturer costs), and has a product price of $67.95/unit

- The oldest Cost Period also has 1 Cost Elements (Manufacturer) with the price $64.5.

Adding And Deleting Cost Periods and Cost Elements

- The following image shows the UI mechanism to add , delete and edit cost periods and cost elements within the cost periods

How To Read A COGS Entry Form

- The following image shows a high-level recap of the previous 2 images for added clarity

🧠 Best Practices

-

Always define an open-ended current cost.

-

Avoid long gaps — profit accuracy depends on continuous cost coverage.

-

Use notes in Detailed View to explain why a cost changed.

-

Document promotions, discounts, and supplier shifts.